DAC/CCS

Modeling direct CO2 capture from the air

A recent IPCC report presents several emission trajectories proposed by different integrated assessment models to meet the Paris Agreement targets. They all envisage a very stringent reduction pathway to reach net zero emissions by the end of the century. Once a net-zero emissions regime is reached, the only emissions that should be allowed are those that are offset by carbon dioxide removal (CDR) activity. Direct air capture with CO2 storage (DAC/CCS) could help considerably in reaching the Paris-Agreement goals.

A long-term Economic Growth Model

F. Babonneau, A. Haurie, M. Vielle, Reaching Paris Agreement goal through carbon dioxide removal development: A compact OR model. Operations Research Letters

In this recent publication, we have proposed a long-term economic growth model for three regions of the world that form coalitions in climate negotiations: the OECD, the emerging BRIC countries, and the rest of the developing world ROW. A full description of the SORMAC-22 model which is a development of the model published in OR-Letters is available here. Below we recall the main results of the OR-Letters publication.

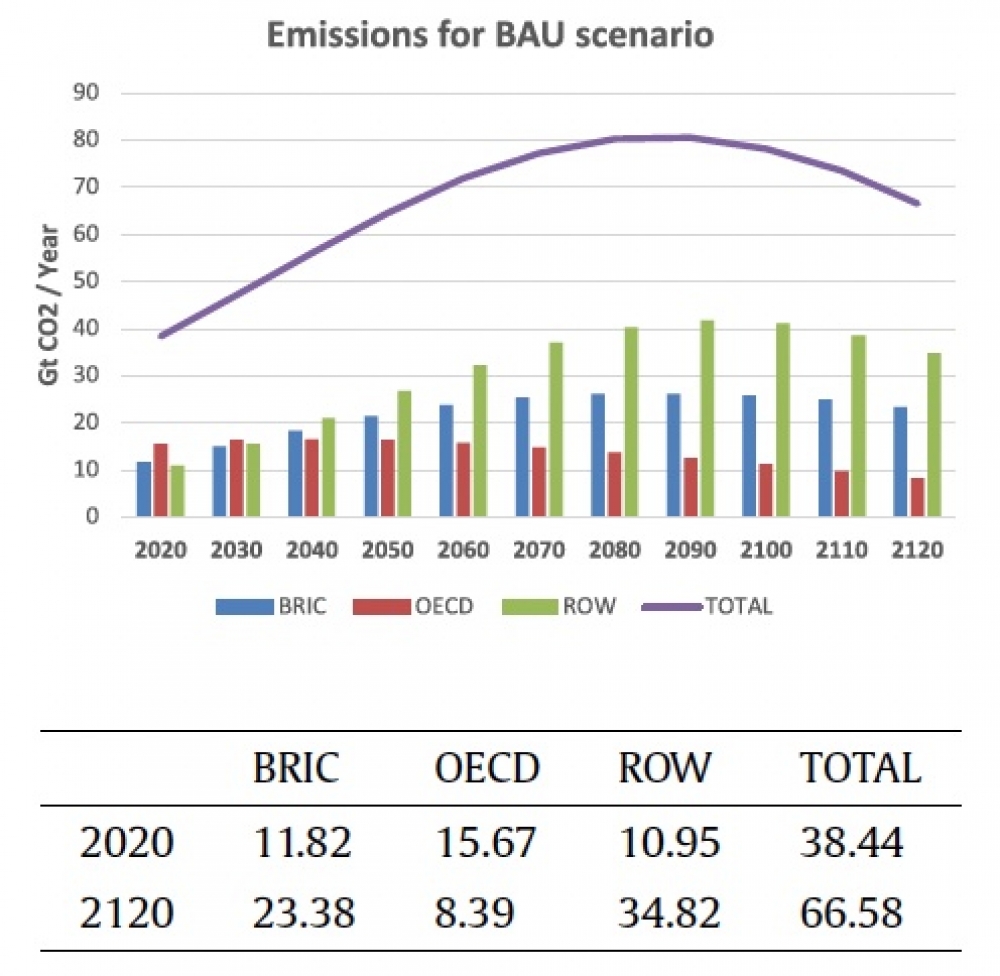

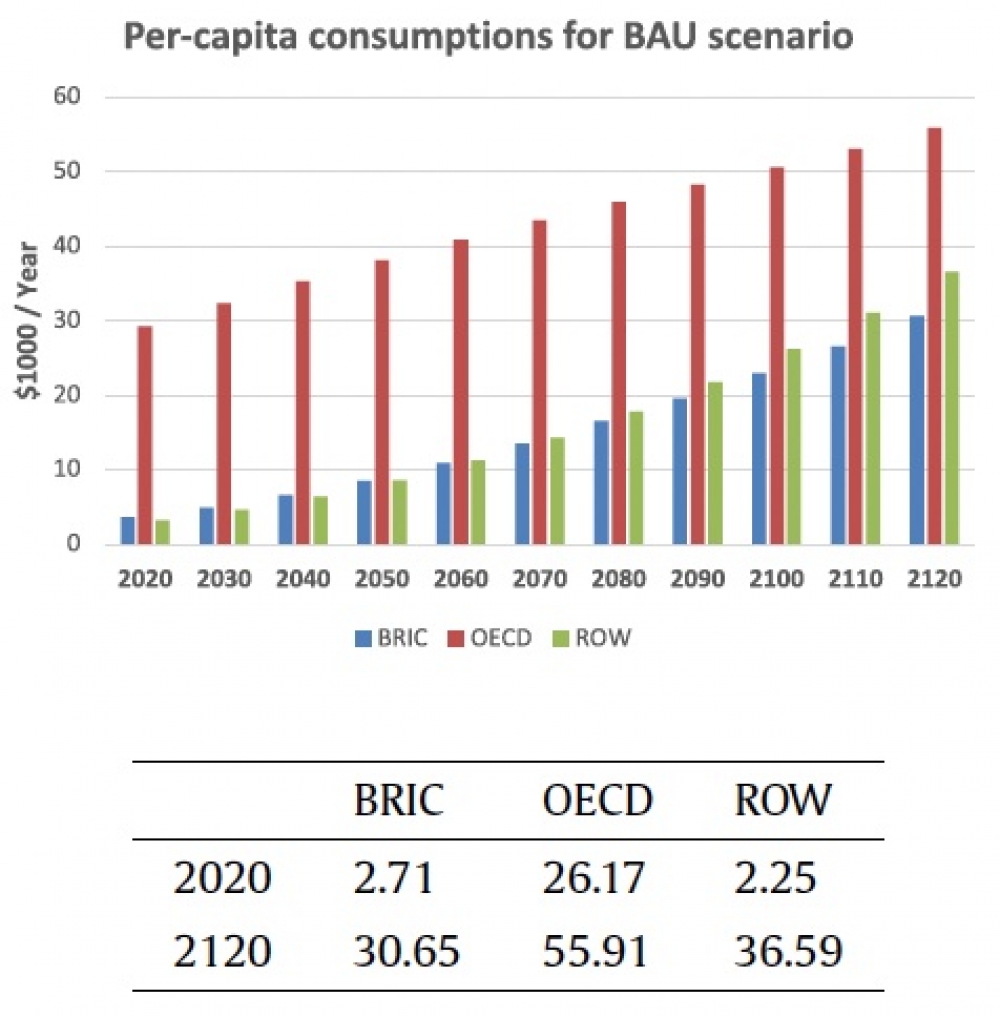

BAU scenario

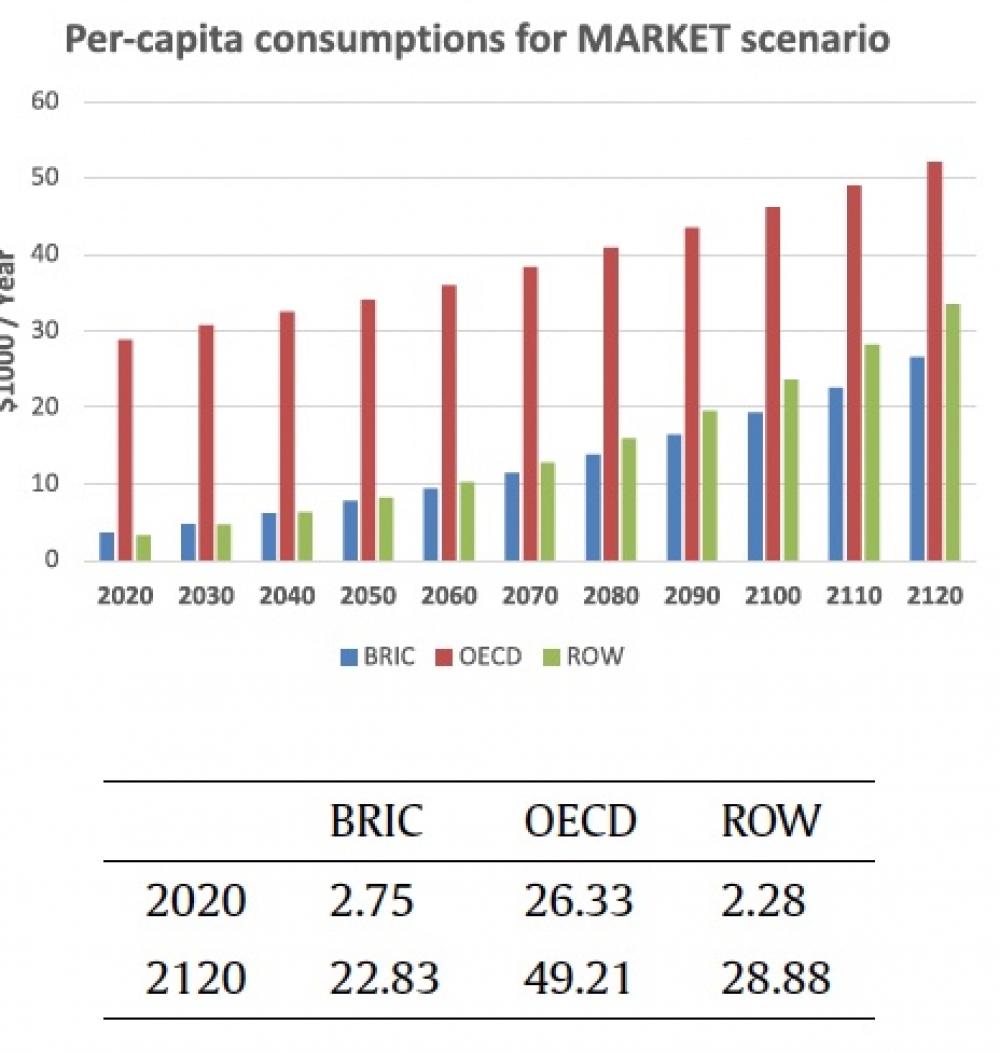

The laissez-faire (BAU) scenario promises annual emissions of up to 80 Gt of CO2 by the end of the century, then falling slightly, due to the progress of renewable energies. Per-capita consumption increases considerably. Of course, this does not take into account the considerable damage that will be caused by global warming.

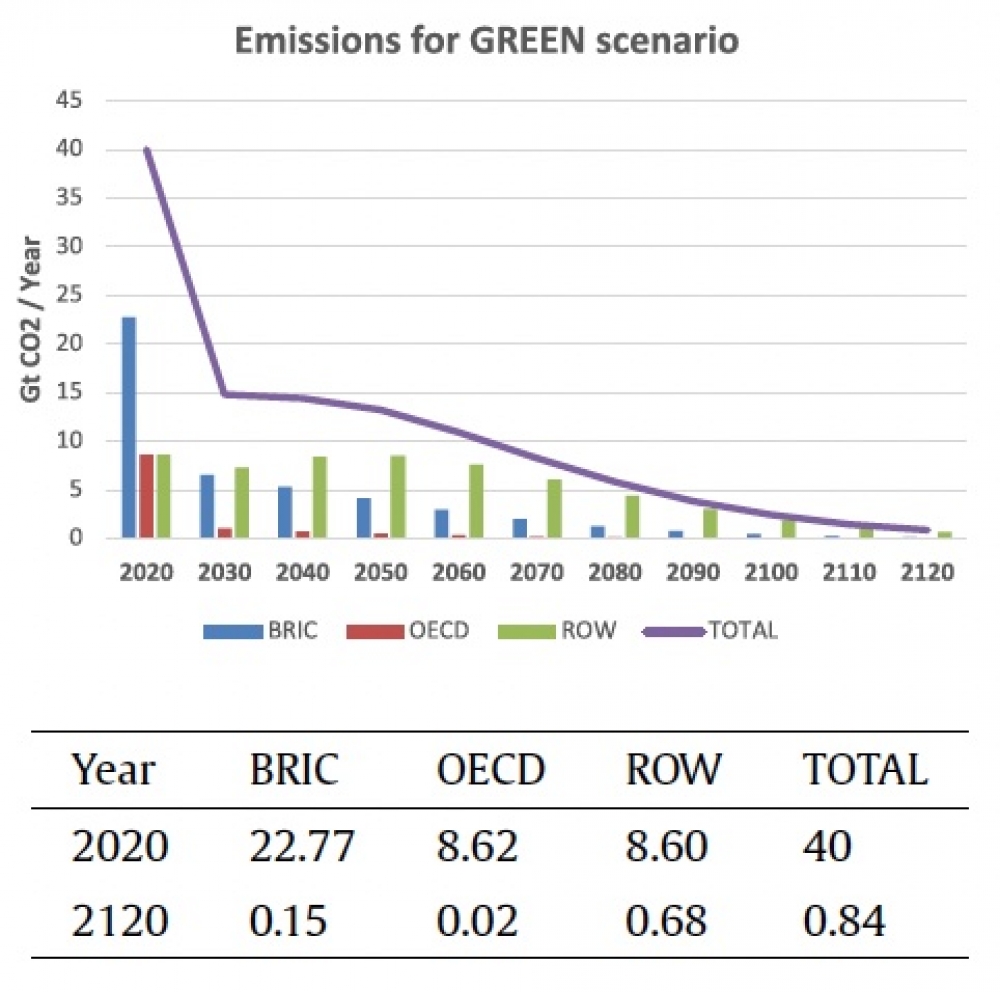

GREEN scenario

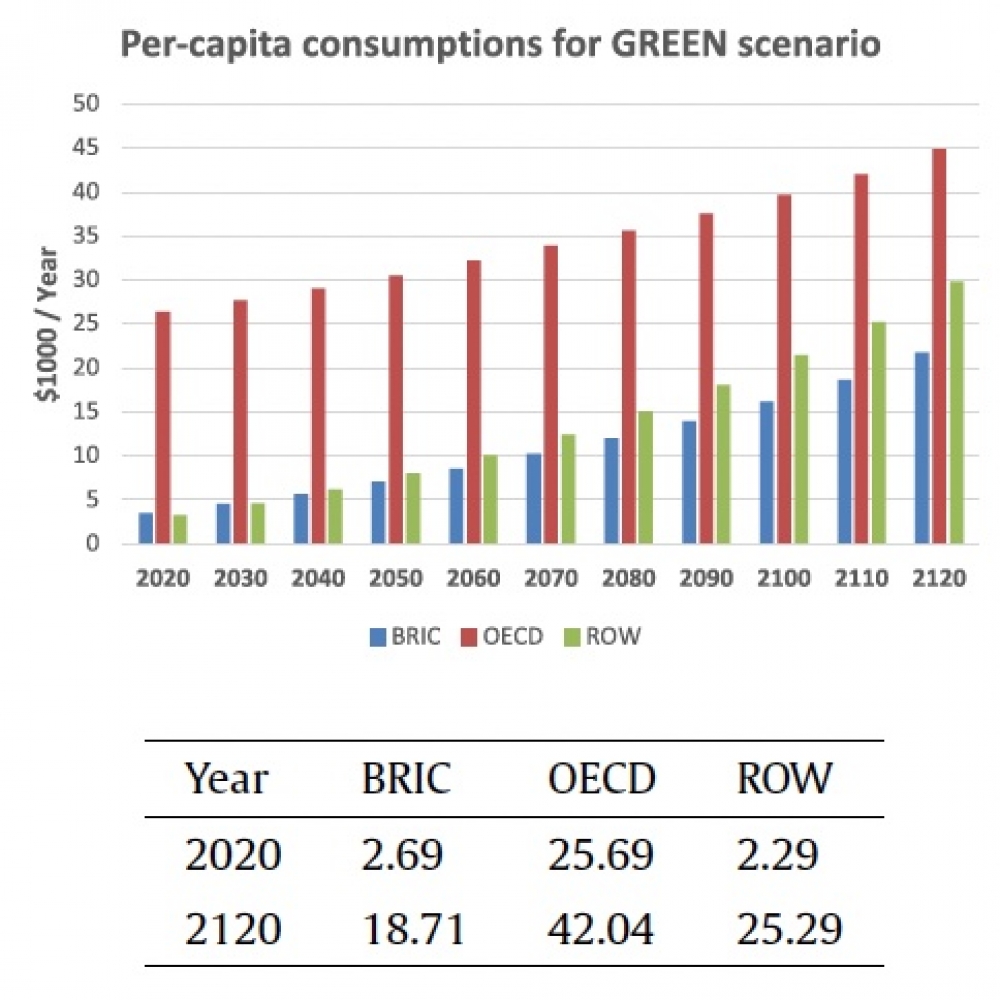

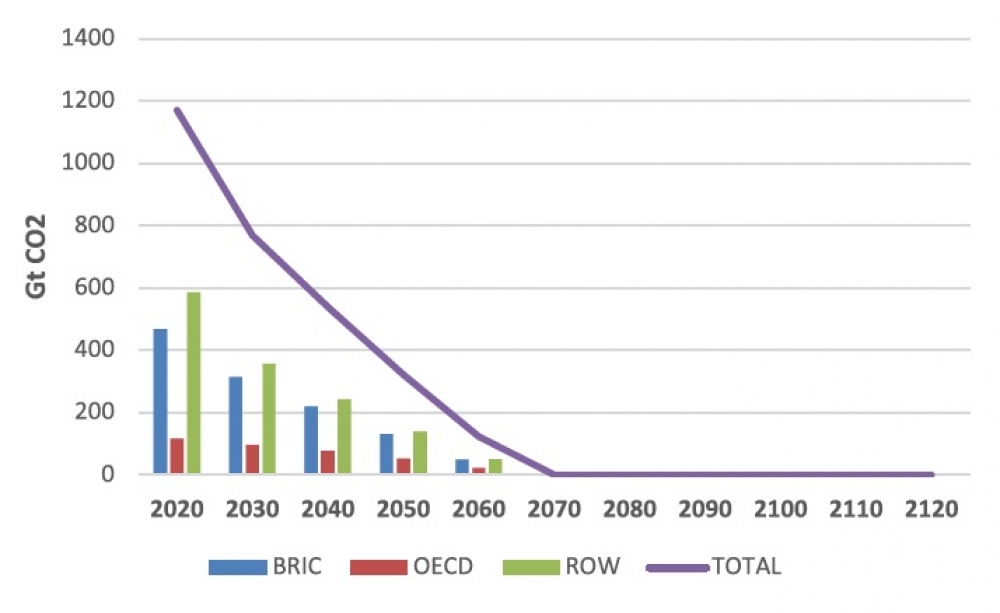

n the GREEN scenario, emissions are limited over the entire planning horizon, with a global budget of 1170 Gt of CO2, which is compatible with a 2oC warming. We see that emissions fall very rapidly, from 40 Gt in 2020 to 15 Gt in 2030, and then slowly decline until 2120.

Per-capita consumption increases, but much less than in the BAU scenario.

MARKET scenario (with DAC/CCS)

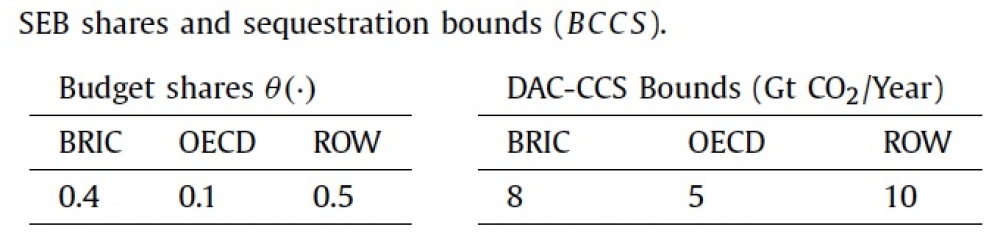

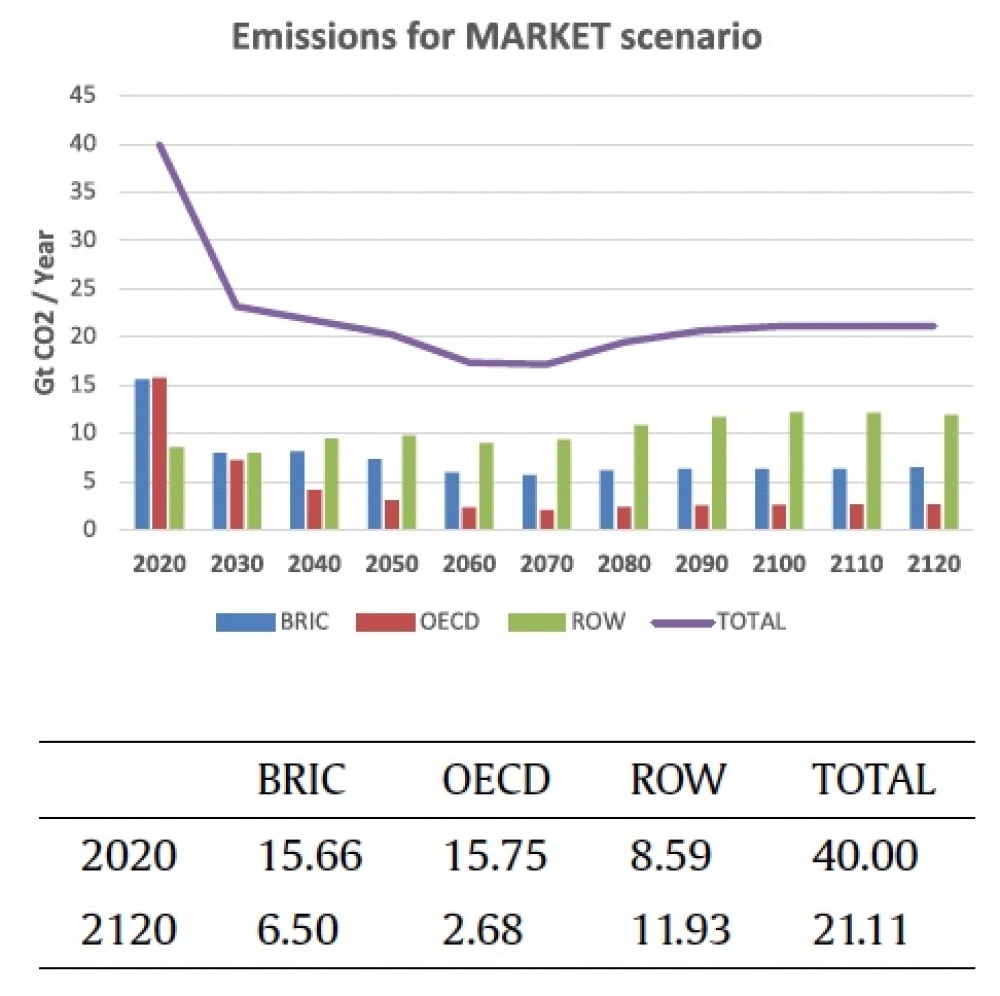

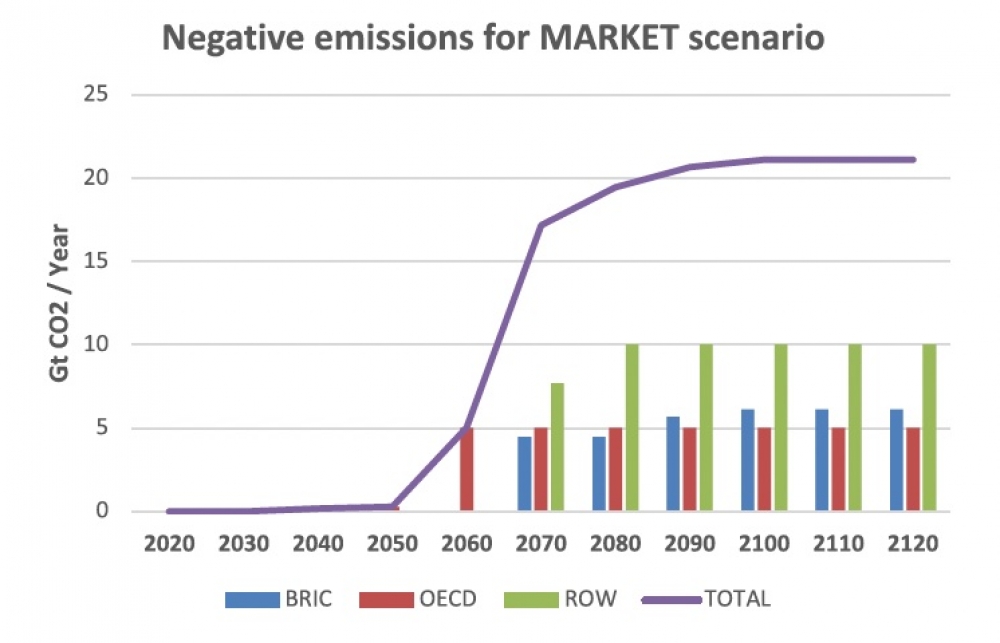

In the MARKET scenario, it is assumed that the global budget of 1,170 Gt of CO2 is split into 40% for BRIC, 50% for ROW and 10% for OECD. It is assumed that an emissions trading market allows the three regions to trade carbon. The sequestration potential in each region is assumed to be 8 Gt per year for BRIC, 5 Gt for OECD and 10 Gt for ROW.

The role of CDR technologies in a carbon neutral regime

F. Babonneau, O. Bahn, A. Haurie, and M. Vielle. An oligopoly game of CDR strategic deployment in a steady-state net-zero emission climate regime. Environmental Modeling and Assessment, Vol.26(1), pages 1-16, December 2021.

We consider a situation at the end of the 21st century or beyond, where development goals in different regions of the world have been met. To represent a "sustainable world", we use a steady-state economic model. Competition between different regions of the world in the supply of emission permits obtained through CDR activities is then represented.

Beyond afforestation, a preferred approach to generating negative emissions is BECCS to generate electricity from biomass (BE) by capturing and sequestering carbon (CCS). However, this approach is not without its risks and limitations, particularly in relation to the amount of arable land needed to grow energy crops. Another alternative is direct carbon capture from the air (DAC). It involves the chemical sorption of diluted CO2 from the circulating air and the release of concentrated CO2 while regenerating these chemicals. In principle, any concentrated CO2 stream produced by CCD or industrial CO2 capture could be recycled into "low carbon" fuels, such as "low carbon diesel". Instead, we consider DACCS, where CO2 captured from both local power plants and DAC facilities is stored in disused gas or oil reservoirs, or in aquifers.

The potential for implementation of DACCS is expected to vary considerably across the world. The first criterion for assessing this potential is the availability of a cheap and emission-free source of energy and heat (e.g. natural gas with CCS, solar or nuclear); a second element is the sequestration potential (e.g. in depleted oil and gas reservoirs, aquifers). DACCS technologies could be quite expensive. Current assessments predict a cost of between US$200 and US$600 per tonne of CO2 removed; however, the price of carbon in 2050 given by various integrated assessment and macroeconomic models is of this order of magnitude.

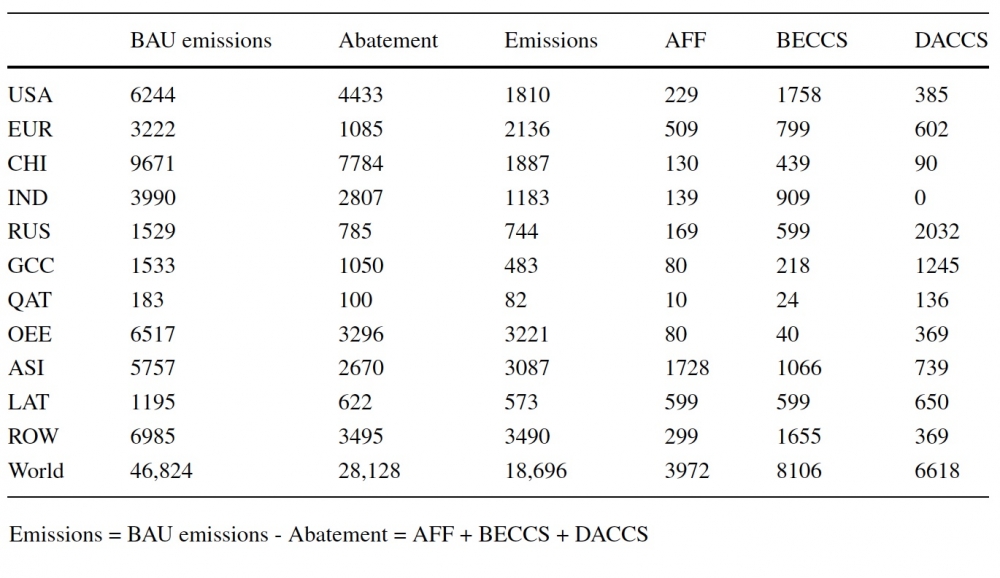

The table below summarises the main results of the simulations carried out using the models we have developed: In a so-called baseline situation (BAU) where only measures related to technical progress are taken, annual CO2 emissions in a steady state are estimated to amount to almost 47 Gt of CO2; if a steady state with carbon neutrality is established, CO2 emissions are reduced to 19 Gt which are fully compensated by diect capture measures, about 4 Gt by afforestation, 8 Gt by BECCS and almost 7 GT BY DACCS.

A hope for the Gulf countries?

F. Babonneau, A. Badran, M. Benlahrech, A. Haurie. Transition to Zero-net emissions for Qatar: A policy based on Hydrogen and CO2 capture & storage development, Energy Policy, Volume 170, Published online November 2022, 113256.

F. Babonneau, A. Badran, M. Benlahrech, A. Haurie, M. Schenckery, and M. Vielle. Economic assessment of the development of CO2 direct reduction technologies in long-term climate strategies of the gulf countries. Climatic Change, Published online 25 April 2021.

The Paris Agreement's objective of limiting the increase in surface air temperature to 2°C, or even 1.5°C, by the end of the 21st century poses an important strategic challenge for oil and gas producing countries. This is particularly the case for the Gulf States (GCC). In a project with Qatar University, ORDECSYS has been involved in evaluating direct carbon reduction (DCR) technologies, particularly those that capture CO2 from the air (DAC), when combined with an international emissions trading market, to mitigate the risks of stranded assets in these regions.

To model the policy context, it is assumed that a global cumulative emissions budget will have been allocated between different coalitions of countries - the GCC being one of them - and that an international emissions trading market has been set up. These coalitions compete in the carbon market and decide on an emissions trading strategy, coupled with a policy to reduce GHG emissions and deploy CDR technologies. The gains for each coalition are assessed using scenario simulations based on a general economic equilibrium model that represents all coalitions involved.

If an international emissions trading system is established, countries with an advantage in developing DACCS activities will have the opportunity to "mine" emission rights. These allowances will be a traded resource on a market, with a very low logistical cost. It could well be that the same countries that enjoyed an oil and gas rent that may disappear under an assertive climate policy will, in the future, obtain a negative emission rent through the implementation of large-scale DACCS systems.

Three scenarios are considered: a) a baseline scenario where there is no limit on the cumulative emissions budget; b) a "green" scenario where the overall cumulative emissions budget is limited to 1170 Gt of CO2 with no possibility of negative emissions; c) a "CDR" scenario where the budget is limited to 1170 Gt of CO2 but coalitions can use direct abatement technologies (bioenergy with capture and sequestration or direct air capture DAC with carbon sequestration) to increase their supply of emissions permits on the international market.

The simulations carried out for these three scenarios indicate that oil and gas producing countries, and in particular GCC countries, face a significant risk of stranded assets, due to "unburnable oil" if a global climate regime as recommended by the Paris Agreement is implemented. The development of CDR technologies, in particular direct air capture (DAC), mitigates this risk somewhat and offers these countries a new opportunity to exploit their gas reserves and carbon storage capacity. Indeed, a DACCS technology based on the use of natural gas as an energy source (electricity and heat) is available, with a cost of less than $300 per tonne of CO2 captured and sequestered. As in our simulations the price of carbon exceeds this level after 2050, negative emissions become a new exploitable resource for countries rich in natural gas and CO2 storage capacity (e.g. in depleted oil reservoirs).